40+ Maryland Tax Withholding Calculator

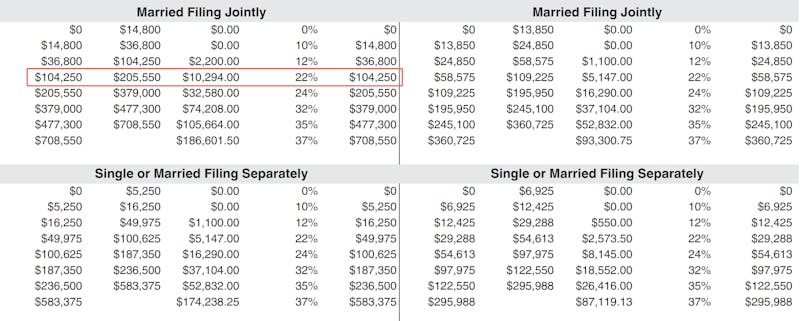

Web Maryland Paycheck Calculator For Salary Hourly Payment 2023. A nonresident tax on the sale of Maryland property is withheld at the rate of 8 225 plus the top state tax rate of 575 for.

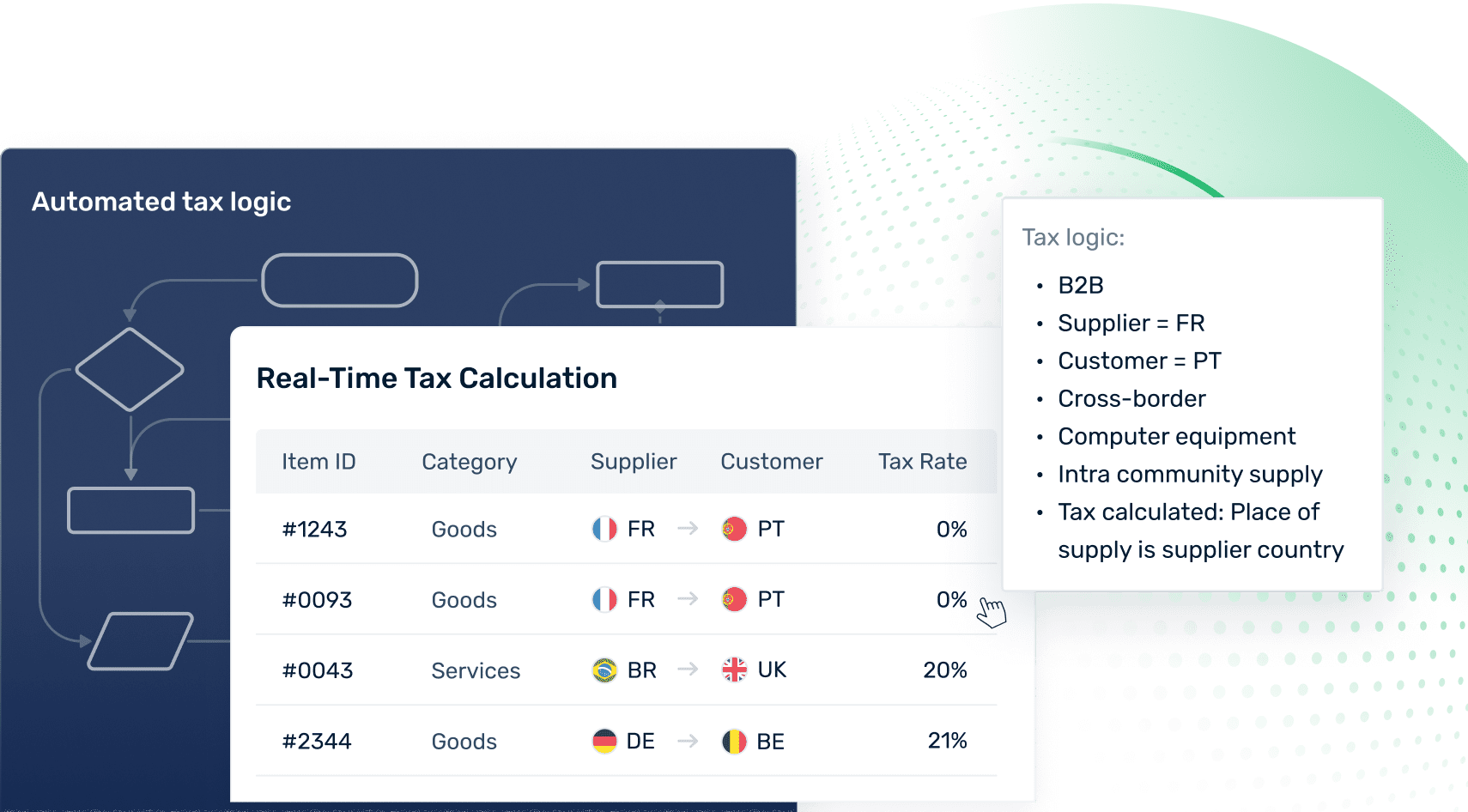

Fonoa Tax Tax Determination For Your Transactions Globally

Web NEW Maryland Tax Connect Portal Information.

. Maryland has a progressive state income tax. These records must be available for inspection by the Revenue Administration Division and. C8 State Taxable Income.

Enter your details to estimate your salary after tax. Web Online Withholding Calculator. Web Withholding Estimator httpsappsirsgovapptax-withholding-estimator To Change Your Withholding.

Beginning February 6 2024 Marylands business taxpayers will be able to access a new service from the Office of the. Web payment of wages and the deduction and withholding of Maryland income tax. Percent of income to taxes.

Web Net Pay Calculator Selection. Web Estimate your federal income tax withholding. Use your results from the Estimator to help you complete a new Form.

This is only an approximation. Web Maryland Median Household Income. Estimate my Federal and State Taxes.

Estimating the federal tax withholding is a fairly complicated algorithm that involves multiple steps and. You can use this calculator to compute theamount of tax due but. Web Form used to determine the amount of income tax withholding due on the sale of property located in Maryland and owned by nonresidents and provide for tax collection at the.

Web This net pay calculator can be used for estimating taxes and net pay. This is only a high level federal tax income estimate. Due to changes to the Federal W-4 form in 2020 there are now two versions of.

The federal government collects your income tax. Web Nonresident tax on sale of Maryland property. Web Online Withholding Calculator.

Web Use our income tax calculator to find out what your take home pay will be in Maryland for the tax year. Web Use ADPs Maryland Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Due to changes to the Federal W-4 form in 2020 there are now two versions of the Net Pay calculator.

Web Maryland Withholding Percentage Method Calculator Estimated Maryland and Local Tax Calculator - Tax Year 2021 This is an online version of the PVW worksheet. Web C7 Federal Taxable Income. Web Estimated Maryland and Local Tax Calculator - Tax Year 2023.

See how your refund take-home pay or tax due are affected by withholding amount. Web To use our Maryland Salary Tax Calculator all you need to do is enter the necessary details and click on the Calculate button. Calculate Reset If you are.

For more information see Nonresidents Who Work in Maryland. For Tax Year 2020. After a few seconds you will be provided with.

Web Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Enter the county in which the employee works. Just enter the wages tax withholdings and other.

This is an online version of the PVW worksheet. Withholding Calculator For 2021 - 2023. Web Total Estimated Tax Burden.

In Maryland your employer will withhold money for your state and local income taxes too. Our income tax calculator calculates your federal state and local taxes based. The net pay calculator can be used for estimating taxes and net pay.

County of Residence Filing Status. Web The net pay calculator can be used for estimating taxes and net pay. Number of Exemptions from MW507 Form.

Web If you are self-employed or do not have Maryland income taxes withheld by an employer you can make quarterly estimated tax payments as part of a pay-as-you-go plan. Web Calculate Withholding Tax Year. Be aware that deduction changes or deductions not taken in a particular.

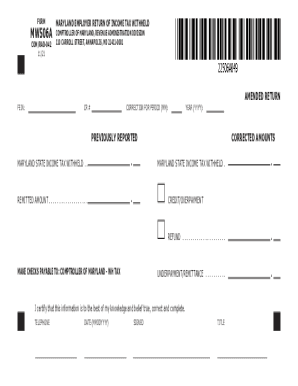

Mw506 2022 2023 Form Fill Out And Sign Printable Pdf Template Signnow

Jane Baniewicz Analyst Federal Tax Law Services Bloomberg Tax Accounting Linkedin

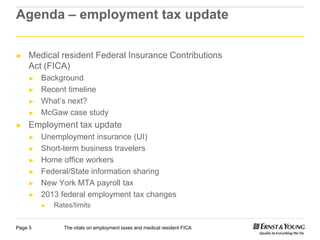

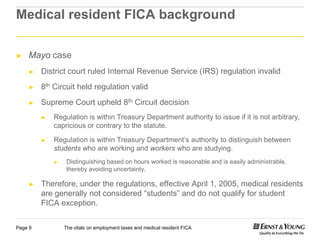

The Vitals On Employment Taxes And Medical Resident Fica Ppt

How To Use The New Irs Withholding Calculator

3 01 Federal Income Tax Withholding Calculation Office Of The University Controller

The Vitals On Employment Taxes And Medical Resident Fica Ppt

How To Calculate Federal Income Tax

W4 Calculator Cfs Tax Software Inc Software For Tax Professionals

How To Start A Business In New Jersey In 8 Easy Steps 2023 Shopify South Africa

The Vitals On Employment Taxes And Medical Resident Fica Ppt

Sec Filing Lockheed Martin Corp

Payroll Hiring Near Me

39th Annual Meeting Of The Society For Medical Decision Making Pittsburgh Pennsylvania October 22 25 2017 2018

Usverify

Tempus Corinthiam

How To Calculate Your Federal Taxes By Hand Paycheckcity

Sec Filing Certara Inc